oregon tax payment voucher

Cash payments must be made at our Salem. Form OR-41-V Oregon Fiduciary Income Tax Payment Voucher Instructions.

2020 2022 Form Or Or 40 V Fill Online Printable Fillable Blank Pdffiller

Fast Easy Secure.

. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to. For more information see. Edit Fill eSign PDF Documents Online.

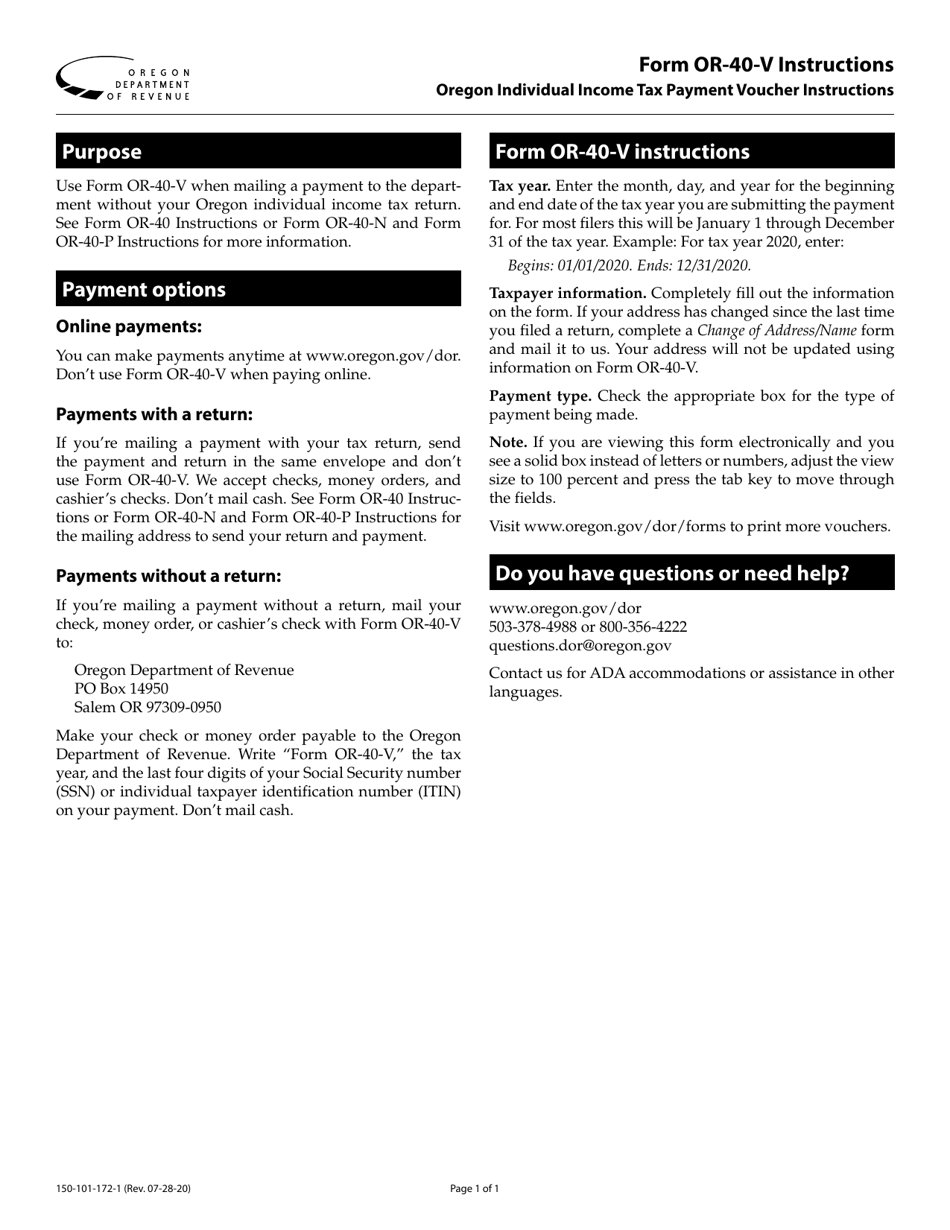

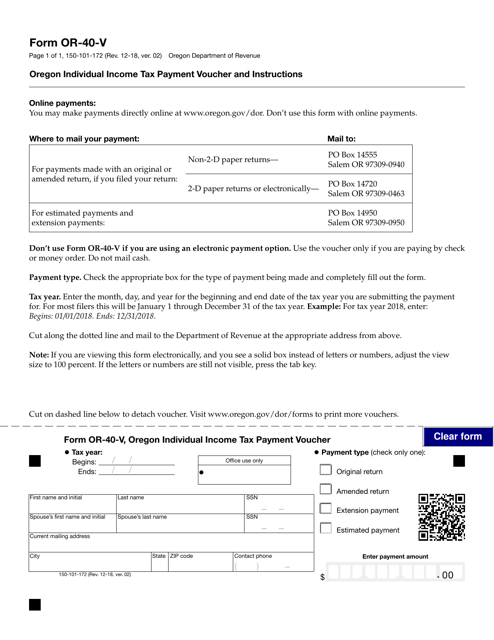

Use this instructional booklet to help you fill. Mail check or money order with voucher to. Estimated Income Tax Payment Voucher Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172 Clear form Form OR-40-V Oregon Department of Revenue.

Oregon State Lodging Tax Payment Voucher and Instructions Page 1 of 1 150-604-172 Rev. Form OR-40-V Oregon Individual Income Tax Payment Voucher Begins. Form OR-41-V Oregon Fiduciary Income Tax Payment Voucher.

Estimated Income Tax Payment Voucher Estimated. Oregon Marijuana Tax Oregon Department of Revenue PO Box 14630 Salem OR 97309-5050. Oregon Department of Revenue Form OR-40-V Oregon Individual Income Tax Payment Voucher and Instructions Page 1 of 1 150-101-172 Rev.

Payment Voucher for Income Tax Voucher. Form 20-V is an Oregon Corporate Income Tax form. Oregon Department of Revenue PO Box 14950 Salem OR 97309-0950 Form OR-19-V instructions Tax year.

Enter the month day and year for the. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to. Payment vouchers are provided to accompany checks mailed to pay off tax liabilities and are used by the revenue department to.

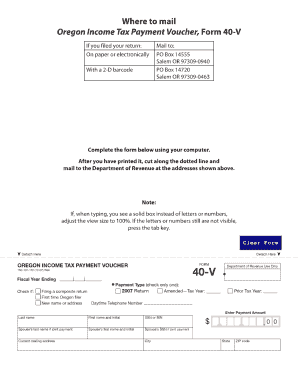

Form 40-V is an Oregon Individual Income Tax form. Ad Download or Email OR OR-40-V More Fillable Forms Register and Subscribe Now. Payments by check or money order will also.

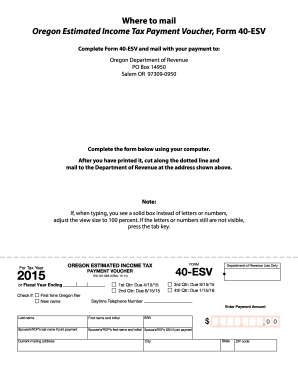

Mail the payment and voucher to. Estimated payment Want to make your payment online. You can use the four estimated tax vouchers included in Form 740-ES to mail your estimated payments to the Kentucky.

Find options at wwworegongovdor. Form 40-V is an Oregon Individual Income Tax form. Your check money order or cashiers check payable to the Oregon Department of Revenue.

Payment can be made by ACH debit or credit while logged into the PTEs Revenue Online account or by using the account number if not logged in. Ad Register and subscribe 30 day free trial to work on your state specific tax forms online. The Multnomah County Preschool for All PFA personal income tax rate is 15 on Multnomah County taxable income over 125000 for individuals and 200000 for joint filers and an.

Enter payment amount Oregon Corporate Activity Tax Payment Voucher Page 1 of 1 Oregon Department of Revenue Use UPPERCASE letters. Use blue or black ink. Resident Individual Income Tax Return Extension.

Use this voucher only if you are making a payment without a return. Print actual size. Tax Payment Vouchers For tax years beginning on or after January 1 2021 you will use BZT-V and CES-V to make quarterly estimated payments.

Payment type check only one. Write Form OR-21-V the filers name federal employer identification number FEIN the tax year. Estimated Income Tax Payment Voucher Form OR-40-V Oregon Individual Income Tax Payment Voucher 150-101-172 Clear form Form OR-40-V Oregon Department of Revenue Oregon.

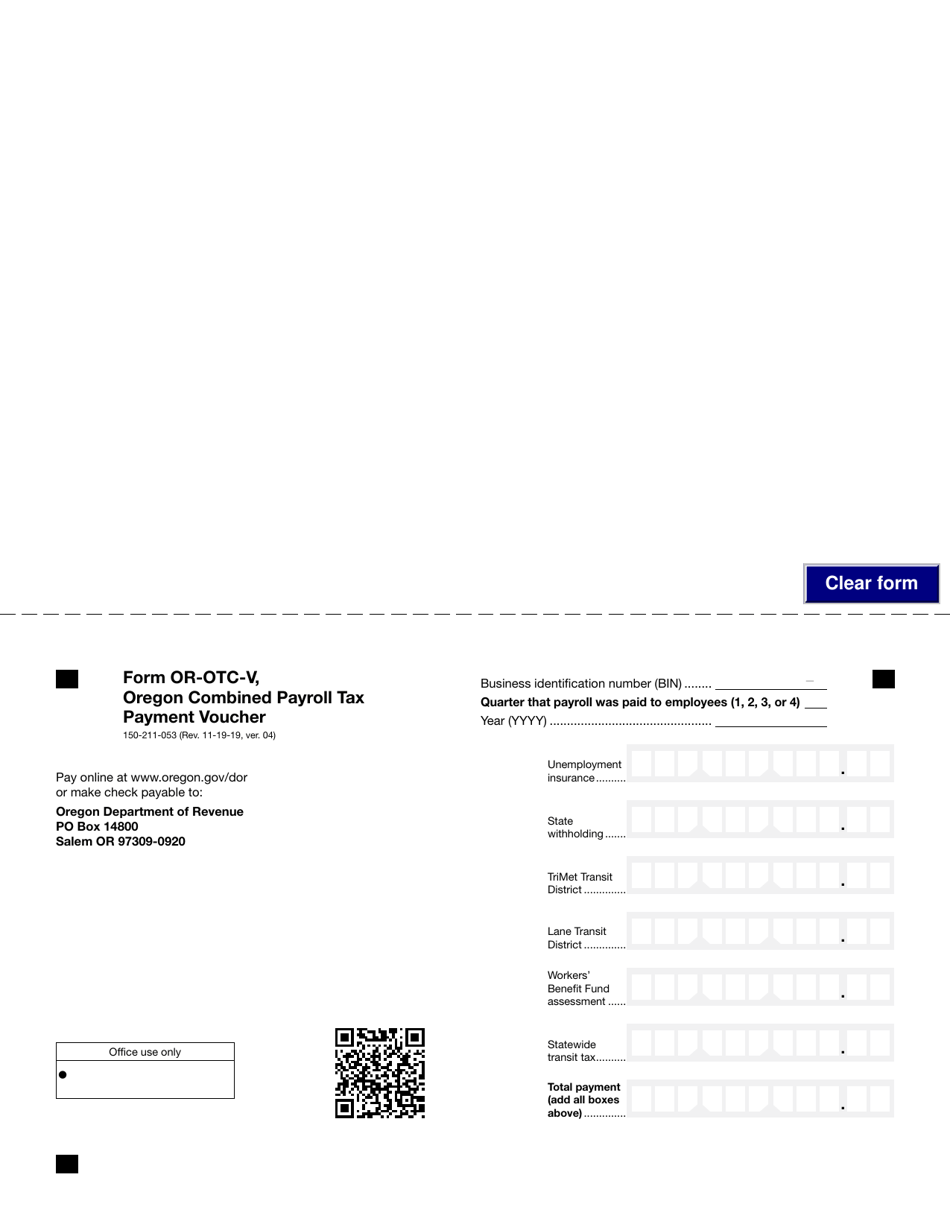

Form Or Otc V 150 211 053 Download Fillable Pdf Or Fill Online Oregon Combined Payroll Tax Payment Voucher Oregon Templateroller

Download Instructions For Form Or 40 V 150 101 172 Oregon Individual Income Tax Payment Voucher Pdf Templateroller

Tax Payment Voucher Fill Online Printable Fillable Blank Pdffiller

Get And Sign Oregon Estimated Tax Payment Voucher 2015 2022 Form

Oregon Estimated Voucher Fill Online Printable Fillable Blank Pdffiller

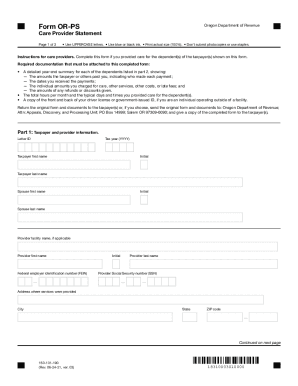

Or Ps Form Fill Out And Sign Printable Pdf Template Signnow

Oregon Tax Forms 2021 Printable State Form Or 40 And Form Or 40 Instructions

Form 50 101 172 Or 40 V Download Fillable Pdf Or Fill Online Oregon Individual Income Tax Payment Voucher Oregon Templateroller